Consumer Invoicing (Finland)

Invoices to consumers in Finland can be sent through Maventa as e-invoices or direct payments to the consumer’s netbank or via email and print. In addition, we support delivery to Kivra, a digital mail service, and through our print service, invoices and letters can also be forwarded to the consumer’s OmaPosti digital mailbox. The priority order for consumer invoice delivery channels is: e-invoice and direct payments, Kivra, email, print (OmaPosti), and print (letter).

Consumer e-invoicing (B2C) in Finland allows suppliers to deliver e-invoices directly to consumers’ online banks. For consumers who do not use online banking, direct debit payments can also be arranged. This service is available only for Finnish companies registered with Maventa. If a Finnish company needs to invoice consumers outside Finland, the only available options are email or print.

The consumer invoice channel allows sending both the invoice image and attachments. Depending on the consumer’s bank, there may also be a link to an invoice display service where the consumer can download the original invoice image and any attached files. Currently, all Finnish banks except Ålandsbanken support downloading the original invoice image and attachments.

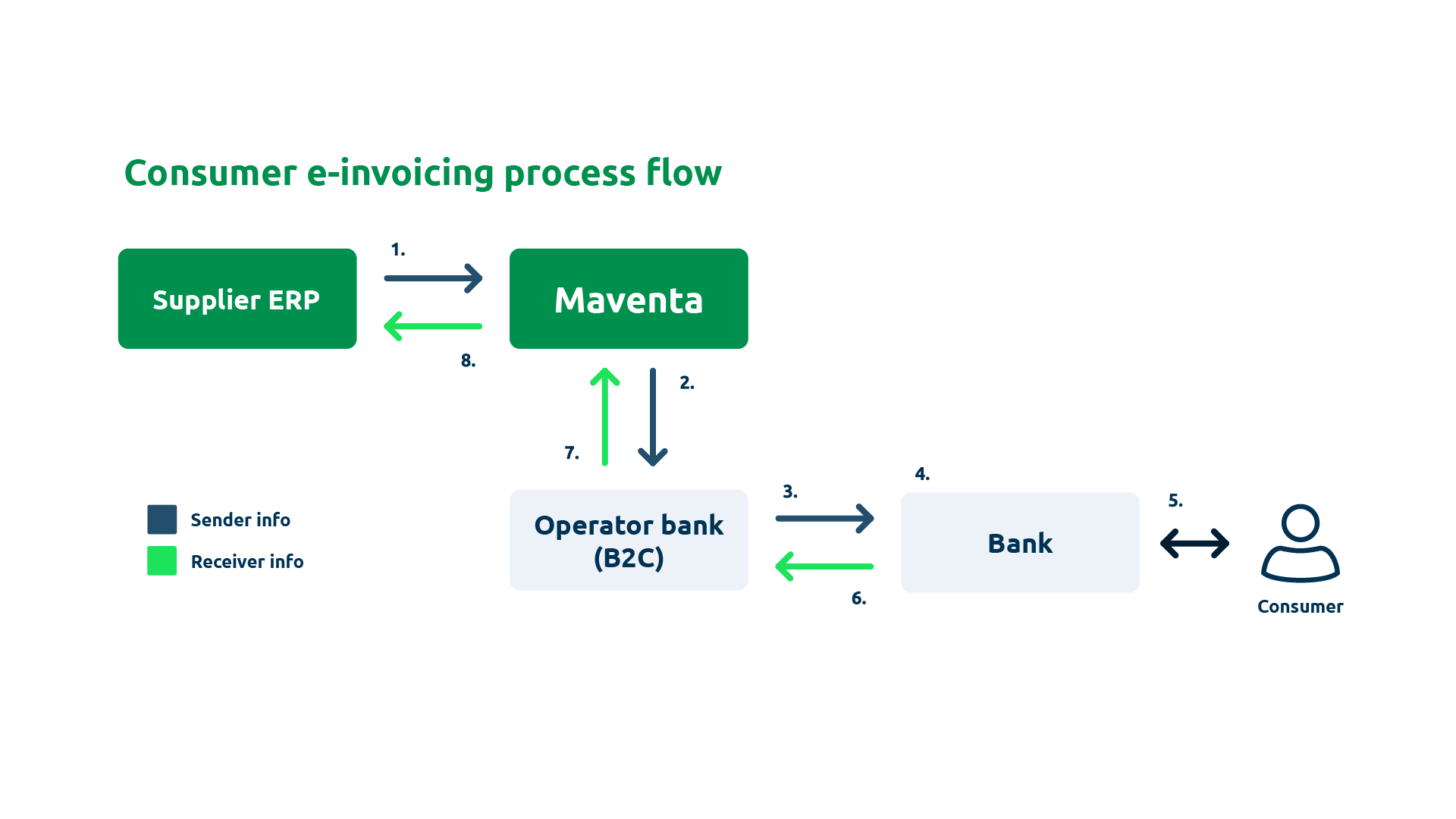

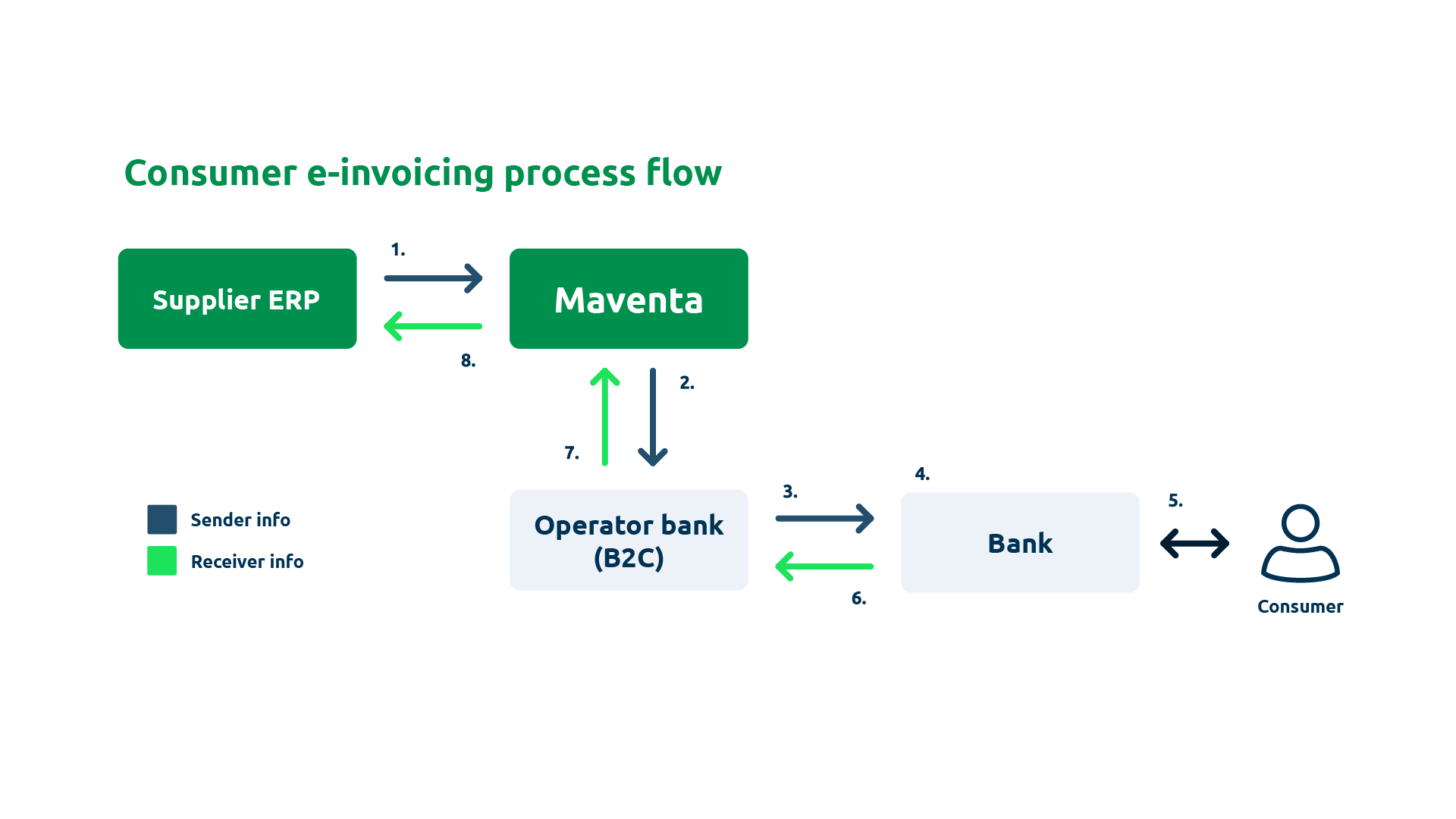

In Finland, B2C e-invoicing to online banks requires activation through bank messaging. Suppliers activate consumer e-invoicing via the Sender Info (SI) message, which informs consumers of the option to receive e-invoices from that supplier. Consumers then confirm their choice with a Receiver Info (RI) message. Additionally, suppliers can use the Receiver Proposal (RP) message to request the consumer’s e-invoice address.

- The supplier’s ERP system creates and sends the SI-messages (SenderInfo) to Maventa via API, or alternatively, the customer can send them through the Maventa UI. A separate message must be sent for each bank the supplier wants to activate for consumer e-invoicing.

- Maventa forwards the SI-messages to the operator bank.

- The operator bank then distributes the SI-messages to the relevant banks.

- Each bank receives the SI-message and records that the supplier is ready to send consumer e-invoices via Maventa. After this, the supplier becomes searchable in the e-invoice registry available in consumers’ netbanks.

- In their online bank, the consumer searches for the supplier by name or business ID and selects the option to receive e-invoices from that supplier. The consumer provides the identification reference requested in the SI-message (for example, a customer or reference number).

- The bank sends an RI-message (ReceiverInfo), a notification that the consumer wishes to receive e-invoices, to the operator bank.

- The operator bank forwards the RI-message to Maventa.

- Supplier’s ERP downloads the RI-message from Maventa and stores the consumer’s information on their end (to consumer registry).

- The supplier is now ready to send e-invoices to that consumer through the netbank.

Before using the consumer e-invoicing channel, the supplier must have an active bank network connection, have sent the SI-message, and received the RI-messages for the consumers they intend to send e-invoices to.

In short:

- Bank network connection is activated. For REST, verify the activation by calling GET /v1/company/profiles and checking that the status for the BANK network is active. When the company authorization request is submitted, a bank network activation request is automatically sent to the bank for processing. The activation process usually takes a few days, depending on Danske Bank’s workload. SI-messages can only be sent once the bank network connection is active.

- SI-messages are successfully sent to each bank the supplier wishes to use.

- Consumer has selected the supplier as their e-invoice sender in their online bank (confirmed via RI-message).

- Consumer e-invoices can be created and send from the ERP.

The SI-message (SenderInfo) is a notification sent to the banking network, where the supplier informs banks and consumers of its readiness to send consumer e-invoices and direct debit payments. It essentially serves as a consumer e-invoicing agreement between the supplier and the bank.

To establish a new agreement, an SI-message with MessageActionCode = ADD must be sent through the Maventa API to each bank the supplier wishes to use for consumer e-invoicing. After sending, you can poll the status of the message.

In Maventa, the status OK is shown as soon as the message has been successfully sent to the operator bank. However, communication between banks may take 1–4 banking days, so possible error messages may appear even after several days. Once all is in order, new RI-messages from consumers will begin to flow in.

If a message fails on the bank side, an error response will be returned. To check SI-message errors, you can first list the error IDs and then retrieve the detailed error message.

If you need to update or add information to an existing agreement, send an SI-message with the type CHANGE. This allows you to modify almost all fields except the billing subject code (PaymentInstructionIdentifier). When updating account information, e-invoice addresses, or intermediaries, both old and new elements are included. Other details are simply overwritten by the new values in the CHANGE message. If you need to change the billing subject code, the old SI-message must first be terminated with a DELETE message, and then a new one created with ADD.

To delete a supplier agreement entirely, send an SI-message with the type DELETE. This will also remove all consumer agreements (RI-messages) linked to that supplier agreement.

Implementation guidelines (Notification Service Guidelines 2.01) and a tool for creating SI-messages (Invoicer Message Program) can be found on Finance Finland’s webpage.

Note: All B2C FI traffic is routed through our intermediary bank, Danske Bank, so the SI-message must always include DABAFIHH as the sender operator code.

SI-messages (and RP-messages) can also be sent through the Maventa user interface (B2C messages → Sent messages). Messages can be uploaded either as separate files (one per message) or as a combined file containing multiple messages. The latter format is generated by the Invoicer Message tool available from Finance Finland’s website.

- To send messages (SI, RP): POST /v1/fi_bank_messages

- To poll the status of sent message: GET /v1/fi_bank_messages/{id}

- To list error message ids: GET /v1/fi_bank_messages/error_messages

- To download a specific error message: GET /v1/fi_bank_messages/error_messages/{id}

Consumer invoices must include a billing subject code, PaymentInstructionIdentifier, an identifier defined by the sender in the SI-message. This code specifies the reason for payment and links the invoice to the correct consumer e-invoicing agreement.

A single supplier may have multiple SI-messages with different billing subject codes. When sending consumer e-invoices, the same billing subject code used in the SI-message must also be included in the invoice XML.

- In Finvoice, the billing subject code is provided in the

EpiPaymentInstructionIDfield. - In TEAPPSXML, the corresponding element is

HEADER / PAYMENT_INSTRUCTION_IDENTIFIER.

To ensure that the reason for payment is displayed to consumers in their online banking, it should also be specified in the SellerInvoiceTypeText element:

<SellerInvoiceDetails>

<PaymentInstructionIdentifier>Vuokra</PaymentInstructionIdentifier>

<SellerInstructionFreeText LanguageCode="FI">Anna viimeisimmän laskun viitenumero </SellerInstructionFreeText>

<SellerInstructionFreeText LanguageCode="SV">Ge den senaste fakturans referensnummer </SellerInstructionFreeText>

<SellerInstructionFreeText LanguageCode="EN">Enter the reference number </SellerInstructionFreeText>

<SellerInvoiceTypeDetails>

<SellerInvoiceTypeText LanguageCode="FI">Vuokra lasku</SellerInvoiceTypeText>

<SellerInvoiceIdentifierText LanguageCode="FI" SellerInvoiceIdentifierType="01">Viitenumero</SellerInvoiceIdentifierText>

</SellerInvoiceTypeDetails>

<SellerServiceCode>01</SellerServiceCode>

</SellerInvoiceDetails>

The supplier’s bank account information is specified in the SellerAccountDetails element of the SI-message. All bank account numbers must be provided in IBAN format, and the supplier must list every account intended for use in consumer e-invoicing. When sending consumer e-invoices, the IBAN included in the invoice must match one of the IBANs defined in the corresponding SI-message.

List of Finnish banks supporting consumer e-invoicing. We recommend to send SI-message to each of these banks:

| Bank Identifier Code | Bank name |

|---|---|

| AABAFI22 | Ålandsbanken |

| DABAFIHH | Danske Bank |

| HELSFIHH | Aktia |

| ITELFIHH | Säästöpankit, Oma Säästöpankki |

| NDEAFIHH | Nordea Pankki |

| OKOYFIHH | OP-Pohjola-ryhmä |

| POPFFI22 | POP Pankit |

| SBANFIHH | S-Pankki |

RI-messages (ReceiverInfo) represent consumer e-invoicing agreements between the consumer and the supplier, and each RI-message is always linked to an existing SI-message. There will be one RI-message per consumer who, through their bank, has chosen to receive e-invoices from the supplier in question.

An RI-message with MessageActionCode ADD is sent to the supplier when a new consumer selects the supplier as their e-invoice sender in their online bank. If a consumer’s details are updated, an RI-message with MessageActionCode CHANGE will be sent, and if a consumer terminates the agreement, an RI-message with MessageActionCode DELETE will be sent.

It is recommended that the supplier maintains an up-to-date consumer registry in their ERP system, reflecting the current status of all RI-messages. New RI-messages should be listed and downloaded daily to keep the registry synchronized. If an e-invoice fails to send due to an inactive consumer agreement, retrieve the latest RI-messages — you will likely find a DELETE message for that consumer.

- To list received RI-messages: GET /v1/fi_bank_messages/ri_messages

- To download RI-message: GET /v1/fi_bank_messages/ri_messages/{id}

- To delete RI-message (file) from Maventa account (note! Use this only after you have downloaded the messages to your ERP, deletion cannot be undone): DELETE /v1/fi_bank_messages/ri_messages/{id}

Handy tip for testing: You can test your integration by sending RI-messages to your own test account using the same method as for sending SI-messages. This allows you to both send and retrieve RI-messages to verify that everything works correctly before moving to production.

Example RI-message

<SOAP-ENV:Envelope xmlns:SOAP-ENV="http://schemas.xmlsoap.org/soap/envelope/" xmlns:eb="http://www.oasis-open.org/committees/ebxml-msg/schema/msg-header-2_0.xsd" xmlns:xlink="http://www.w3.org/1999/xlink">

<SOAP-ENV:Header>

<eb:MessageHeader SOAP-ENV:mustUnderstand="1" eb:id="20200731110324320000" xmlns:eb="http://www.oasis-open.org/committees/ebxml-msg/schema/msg-header-2_0.xsd">

<eb:From>

<eb:PartyId>FI4941452835555555</eb:PartyId>

<eb:Role>Sender</eb:Role>

</eb:From>

<eb:From>

<eb:PartyId>SBANFIHH</eb:PartyId>

<eb:Role>Intermediator</eb:Role>

</eb:From>

<eb:To>

<eb:PartyId>003712345678</eb:PartyId>

<eb:Role>Receiver</eb:Role>

</eb:To>

<eb:To>

<eb:PartyId>DABAFIHH</eb:PartyId>

<eb:Role>Intermediator</eb:Role>

</eb:To>

<eb:CPAId>yoursandmycpa</eb:CPAId>

<eb:ConversationId>nnnn</eb:ConversationId>

<eb:Service>Routing</eb:Service>

<eb:Action>ProcessReceiver</eb:Action>

<eb:MessageData>

<eb:MessageId>2020083111032432000022</eb:MessageId>

<eb:Timestamp>2023-09-31T11:03:24+03</eb:Timestamp>

<eb:RefToMessageId>20150609223129270000</eb:RefToMessageId>

</eb:MessageData>

</eb:MessageHeader>

</SOAP-ENV:Header>

<SOAP-ENV:Body>

<eb:Manifest eb:id="Manifest" eb:version="2.0">

<eb:Reference eb:id="Finvoice" xlink:href="20200731110324320000">

<eb:schema eb:location="http://www.pankkiyhdistys.fi/verkkolasku/finvoice/finvo" eb:version="2.0"/>

</eb:Reference>

</eb:Manifest>

</SOAP-ENV:Body>

</SOAP-ENV:Envelope>

<?xml version="1.0" encoding="ISO-8859-15"?>

<?xml-stylesheet type="text/xsl" href="FinvoiceReceiverInfo.xsl"?>

<FinvoiceReceiverInfo Version="2.0" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xsi:noNamespaceSchemaLocation="FinvoiceReceiverInfo.xsd">

<MessageDetails>

<MessageTypeCode>RECEIVERINFO</MessageTypeCode>

<MessageTypeText>VASTAANOTTAJAN ILMOITUS</MessageTypeText>

<MessageActionCode>ADD</MessageActionCode>

<MessageActionCodeIdentifier>00</MessageActionCodeIdentifier>

<MessageDate Format="CCYYMMDD">20200831</MessageDate>

<SenderInfoIdentifier>testi</SenderInfoIdentifier>

</MessageDetails>

<SellerPartyDetails>

<SellerPartyIdentifier>1234567-8</SellerPartyIdentifier>

<SellerOrganisationNames LanguageCode="FI">

<SellerOrganisationName>Your Software Oy</SellerOrganisationName>

</SellerOrganisationNames>

<SellerOrganisationNames LanguageCode="SV">

<SellerOrganisationName>Your Software Oy</SellerOrganisationName>

</SellerOrganisationNames>

<SellerOrganisationNames LanguageCode="EN">

<SellerOrganisationName>Your Software Oy</SellerOrganisationName>

</SellerOrganisationNames>

<SellerOrganisationBankName>Your Software Oy</SellerOrganisationBankName>

<SellerPostalAddressDetails>

<SellerStreetName>Tie 6</SellerStreetName>

<SellerTownName>Helsinki</SellerTownName>

<SellerPostCodeIdentifier>00200</SellerPostCodeIdentifier>

<CountryCode>FI</CountryCode>

<CountryName>SUOMI</CountryName>

</SellerPostalAddressDetails>

</SellerPartyDetails>

<InvoiceSenderInformationDetails>

<SellerWebaddressText>www.yritys.fi</SellerWebaddressText>

<InvoiceSenderAddress>00372345678</InvoiceSenderAddress>

<InvoiceSenderIntermediatorAddress>DABAFIHH</InvoiceSenderIntermediatorAddress>

</InvoiceSenderInformationDetails>

<SellerAccountDetails>

<SellerAccountID IdentificationSchemeName="IBAN">FI4941452835555555</SellerAccountID>

<SellerBic IdentificationSchemeName="BIC">NDEAFIHH</SellerBic>

</SellerAccountDetails>

<SellerInvoiceDetails>

<PaymentInstructionIdentifier>Lasku</PaymentInstructionIdentifier>

<SellerInstructionFreeText LanguageCode="FI">Syötä yritykseltä saamasi rekisteröintitunnus.</SellerInstructionFreeText>

<SellerInstructionFreeText LanguageCode="SV">Ange registrerings-ID du fått från företaget.</SellerInstructionFreeText>

<SellerInstructionFreeText LanguageCode="EN">Enter the registration ID you received from the company.</SellerInstructionFreeText>

<SellerInvoiceTypeDetails>

<SellerInvoiceTypeText LanguageCode="FI">Liikuntamaksu</SellerInvoiceTypeText>

<SellerInvoiceIdentifierText LanguageCode="FI" SellerInvoiceIdentifierType="99">Rekisteröintitunnus</SellerInvoiceIdentifierText>

</SellerInvoiceTypeDetails>

<SellerInvoiceTypeDetails>

<SellerInvoiceTypeText LanguageCode="SV">Motionsavgift</SellerInvoiceTypeText>

<SellerInvoiceIdentifierText LanguageCode="SV" SellerInvoiceIdentifierType="99">Registeringsnummer</SellerInvoiceIdentifierText>

</SellerInvoiceTypeDetails>

<SellerInvoiceTypeDetails>

<SellerInvoiceTypeText LanguageCode="EN">Exercise fee</SellerInvoiceTypeText>

<SellerInvoiceIdentifierText LanguageCode="EN" SellerInvoiceIdentifierType="99">Registration ID</SellerInvoiceIdentifierText>

</SellerInvoiceTypeDetails>

</SellerInvoiceDetails>

<ReceiverInfoTimeStamp>2023-09-19T11:03:24+03</ReceiverInfoTimeStamp>

<BuyerPartyDetails>

<BuyerOrganisationName>Matti Mallikas</BuyerOrganisationName>

<BuyerPostalAddressDetails>

<BuyerStreetName>katu 1</BuyerStreetName>

<BuyerTownName>PORVOO</BuyerTownName>

<BuyerPostCodeIdentifier>06100</BuyerPostCodeIdentifier>

<CountryCode>FI</CountryCode>

<CountryName>SUOMI</CountryName>

</BuyerPostalAddressDetails>

</BuyerPartyDetails>

<InvoiceRecipientDetails>

<InvoiceRecipientAddress>FI4941452835555555</InvoiceRecipientAddress>

<InvoiceRecipientIntermediatorAddress>SBANFIHH</InvoiceRecipientIntermediatorAddress>

<SellerInvoiceIdentifier>123456</SellerInvoiceIdentifier>

<InvoiceRecipientLanguageCode>FI</InvoiceRecipientLanguageCode>

</InvoiceRecipientDetails>

<BuyerServiceCode>00</BuyerServiceCode>

<ConversionDetails/>

</FinvoiceReceiverInfo>

The RP-message (ReceiverProposal) is used by the supplier to request a consumer’s e-invoice address before e-invoices can be sent. When the consumer accepts the proposal, a corresponding RI-message is sent to the supplier. The RP-message is therefore a useful way to encourage more consumers to start using e-invoicing. Although there must be an agreement between the supplier and the consumer that the supplier will request the e-invoice address via RP-message.

- The supplier sends an RP-message through Maventa with MessageActionCode set to ADD, MessageActionCodeIdentifier value as 00 and consumer’s personal identification number (SSN) in the BuyerPartyIdentifier field.

- Maventa forwards the RP-message to the operator bank.

- The bank displays the RP-message in the consumer’s netbank for approval.

- Once approved, the bank responds with an RI-message containing the consumer’s e-invoicing address. Note that the personal identification number is not included in the RI-message. The RI-message is then forwarded via the operator bank and Maventa to the supplier.

- The supplier updates the consumer’s information in their system.

- The supplier can now send the next invoice as an e-invoice.

Note: If the consumer does not respond within 30 calendar days, the bank deletes the RP-message from the consumer’s netbank. This deletion is not acknowledged with a separate message.

-

Billing subject code is mandatory for consumer e-invoices: Finvoice → EpiPaymentInstructionID and TEAPPSXML → HEADER / PAYMENT_INSTRUCTION_IDENTIFIER. This field identifies the invoice as a consumer invoice. If you are using a format such as Peppol BIS, which does not include this mandatory field required for Finnish B2C invoices, you can provide it through the API when sending the invoice. In the POST /v1/invoices endpoint, this can be specified using the payment_instruction_identifier field.

-

Invoice type codes: Finvoice: InvoiceTypeCode (INV01 → Consumer e-invoice and INV09 → Direct debit). TEAPPSXML: HEADER / INVOICE_TYPE (00 → Consumer e-invoice and 08 → Direct debit).

-

No Business ID is used for consumer e-invoices (the Business Identity Code / Y-tunnus should be omitted).

-

When sending consumer e-invoices, you must use the same supplier account information (IBAN(IBANs)) as in the SI message. If the IBAN differs, the bank will reject the invoice.

-

Allow at least three (3) days between sending the invoice and its due date to ensure the consumer has enough time to make the payment.

-

For the direct payment, Maventa does not automatically send notifications. You need to handle them yourself. Many of our integrators use the Mass Printing Service to send payment notifications by letter, either one annual summary listing all upcoming direct payments or monthly individual notifications.

-

Credit Note and Cancellation Invoice are also supported: Finvoice InvoiceTypeCode INV02 and total amount must always be negative.

Consumer e-invoicing can be deactivated by sending SI messages with the type DELETE. This action removes the supplier’s agreements with the banks and deletes the supplier from the list of companies offering consumer e-invoicing in online banks. Deleting an SI message also removes all consumer agreements (RI messages) linked to that supplier agreement. If you only need to update the service provider or other details, there is no need to delete the existing agreement. Simply send an SI message with the type CHANGE, and the information will be updated automatically.

When changing the service provider, you must send SI messages with the type CHANGE from the current service provider. In these messages, specify the new service provider. This ensures that all existing consumer agreements (RI messages) are automatically transferred to the new provider, without any action required from consumers. Important: It may take a few banking days for the SI messages to reach and be validated by all banks. During this time, error messages may still arrive. Therefore, do not close the old connection immediately! wait at least five banking days after sending the SI messages. If no errors are received after that, the old connection can be safely closed.

Please also note that RI message files from the old service provider are not automatically transferred to the new one. Make sure you have downloaded or saved all necessary RI message data before the change.

InvoiceSenderAddress and InvoiceSenderIntermediatorAddress should have the current sender information and with NewInvoiceSenderAddress and NewInvoiceSenderIntermediatorAddress you can inform the new sender information:

<InvoiceSenderInformationDetails>

<InvoiceSenderAddress>003712345678</InvoiceSenderAddress>

<InvoiceSenderIntermediatorAddress>DABAFIHH</InvoiceSenderIntermediatorAddress>

<NewInvoiceSenderAddress>003787654321</NewInvoiceSenderAddress>

<NewInvoiceSenderIntermediatorAddress>NDEAFIHH</NewInvoiceSenderIntermediatorAddress>

</InvoiceSenderInformationDetails>

Kivra is a digital mail service that allows consumers to receive invoices, letters, and various documents in an electronic format. To learn more about Kivra, visit their website at https://kivra.fi/.

Companies can utilize Kivra through Maventa to send invoices to consumers. Also, consumers have the option to make payments for the invoices through the service.

Kivra functions as one of the electronic routes (relay) in our automated routing, positioned after e-invoice and before email routes. If an invoice is sent without the consumer’s full e-invoice address (IBAN and bank operator), lookup towards Kivra’s consumer registry is performed based on the data on the invoice. If a consumer has a Kivra account, and hasn’t blocked invoices from the sender in question (based on the sender’s bid), invoice is delivered to their Kivra account. In case the Kivra route fails, the invoice is routed via the next available route, such as email or print.

The invoice image, along with any PDF attachments, is sent to Kivra as a combined package of up to 10 MB in total. If the total size exceeds 10 MB, the Kivra route is skipped and the invoice is sent via the next available route—email or print. If none of these routes are available, the invoice will end up in an error state.

Kivra delivery can now also be attempted as part of the print delivery route. In the POST /v1/invoices, you can include a new optional parameter under print_settings: allow_kivra_fi

When this parameter is set, the system will attempt to deliver the invoice via Kivra before defaulting to print — even if print is the only explicitly allowed route. This allows for Kivra delivery attempts without requiring e-invoice route activation.

The consumer match against Kivra’s registry is performed using one of the following sets of data from the invoice XML:

- Email address (verified when the consumer activates their Kivra account)

- Full name + street address + postal code + post office (Kivra syncs address data from official registries)

- Full name + phone number

- The Kivra route cannot be disabled independently — turning off the e-invoice route also disables Kivra.

- The invoice must include a valid reference number and complete payment information.

- The maximum package size allowed for Kivra delivery is 10MB. Bigger packages are might get delivered.

OmaPosti is an application that allows consumers to receive their letters electronically instead of in a paper form. In case a consumer invoice is going to print, our print service provider will do a look up towards the OmaPosti consumer registry. When a consumer has an active OmaPosti account and has not opted out of receiving digital letters from a sender in question (based on the Maventa account’s OVT code), the invoice will be redirected to the consumer’s OmaPosti account instead of being delivered as a paper document. However, if the consumer does not have an OmaPosti account, the invoice will be printed and sent as a paper letter to the consumer.

To determine if a consumer has an OmaPosti account, a combination of their name and postal address or social security number is used for identification. It is good to keep in mind that while a social security number (ssn) can be used as an identifier, it is highly recommended not to include such sensitive information on invoices.

It is also possible for the sender to exclude an invoice from being sent through the OmaPosti route by setting a parameter print_settings[prevent_digital_post] to “true” while using POST /v1/invoices.

In summary, OmaPosti provides a digital alternative for receiving letters and in Maventa OmaPosti works only through the print route. Specific criteria mentioned above are used to determine whether an invoice should be sent electronically or as a physical document.