Detect

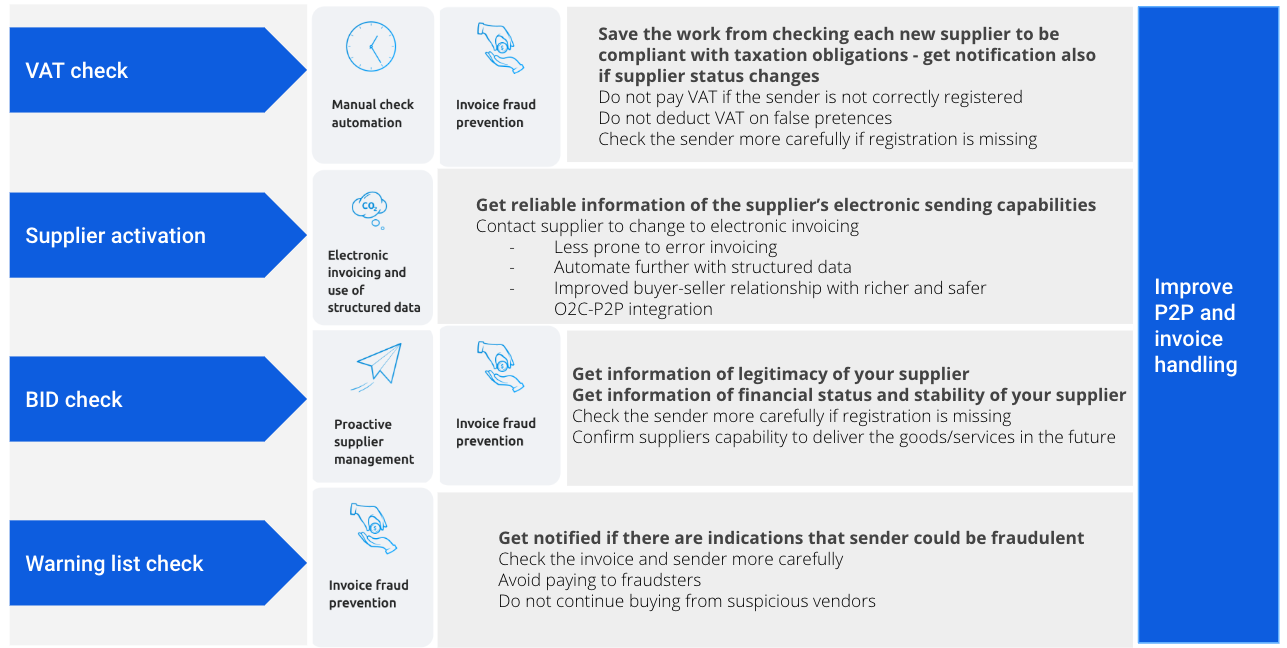

Detect is an automated service that verifies incoming invoices and their supplier details. Its checks and notifications help companies automate invoice processing, detect potential fraud attempts, and prevent errors in payments and accounting. The service is integrated into the invoice receiving flow, ensuring that notifications can be shown in the right context.

VAT- For invoices that include value-added tax (VAT), Detect verifies that the sender is registered in the relevant VAT register. If the total VAT amount on the invoice is below 1 EUR/NOK/SEK (depending on currency), the sender will not be checked against the VAT register. The data sources used for these checks depend on the sender’s country:

- Norway: Brønnøysundregistrene – https://brreg.no

- EU countries: VIES – https://ec.europa.eu/taxation_customs/vies/

- Other countries: Not supported

SUPPLIER_ACTIVATION- For scanned invoices, check if supplier could have sent the invoice electronically

SENDER_BID_STATUS - Verifies the sender’s business identifier against central business and bankruptcy registers. This check is available for invoices from Norwegian and Finnish senders and, for Finland, also includes a check against the Prepayment Register.

The check validates that the invoice sender’s business ID is registered and active in the national company register. It also returns information about whether the company is undergoing insolvency or bankruptcy proceedings.

The registers used for this verification depend on the sender’s country:

- Finland – YTJ http://www.ytj.fi

- Norway – Brønnøysundregistrene https://brreg.no

- Other countries – Not supported

SENDER_WARNING_LIST - Verifies the invoice sender against registers that list suspected fraudsters and businesses involved in scams or swindles.

BANK_ACCOUNT_CHANGED - Checks whether the sender has updated their bank account number. Applicable for Peppol and scan invoice routes.

Detect is integrated into the incoming invoice workflow via the REST API.

-Detect checks are activated by the receiving company. Once activated, all incoming invoices for that company in Maventa are automatically checked. When an invoice becomes available for download, the corresponding check results are also available to retrieve and display.

-

Maventa performs the checks and provides predefined descriptions, notification statuses, and messages. Texts and translations are available in EN, NO, FI, SE, DK, and NL.

-

Activation and display of the check results occur within the integrated system (the company’s financial software or ERP).

- Activate Detect PATCH/v1/services/detect/checks

- Fetch results GET /v1/invoices/{id}/detect_results

- Present results

- Customer has accepted the Terms of Service for Maventa

- Customer has accepted the General Disclaimer for the service (available at the end of this guide)

For Detect, authenticate as a company and select the authentication scope analysis.

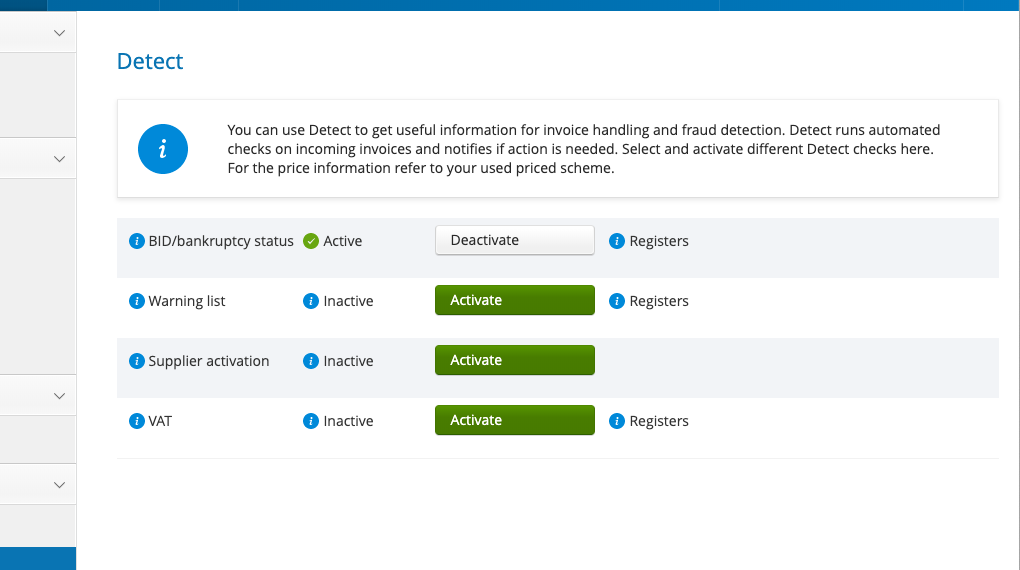

To start using Detect for a company, the user activates the checks they want to use.

The user must first be shown and accept the General Service Disclaimer before activating any checks.

Use the GET/v1/definitions/detect/checks endpoint to retrieve and show all available checks and related information to the user, including which registers are used for each check.

Use PATCH/v1/services/detect/checks to activate checks:

- Provide an array of check identifiers to activate for the specific company.

- A successful activation returns status OK. From that point on, the selected checks are automatically run for all incoming invoices of the company.

Use GET/v1/services/detect/checks to confirm which checks are activated.

Example check activation in our user interface:

Once activated, all incoming invoices for the company are automatically checked. When checks are completed, the invoice is released to the customer’s inbox and check results are available via the REST API. Invoices and attachments are downloaded as usual. Detect results are retrieved via a separate API call:

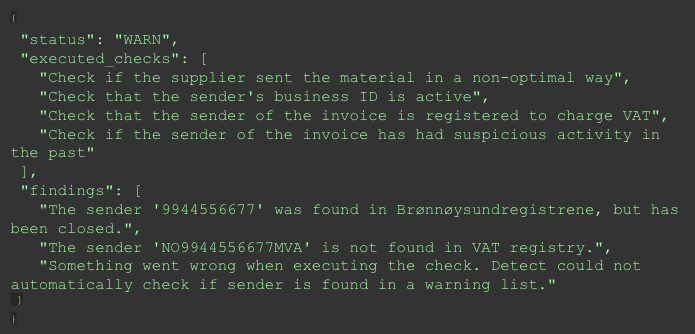

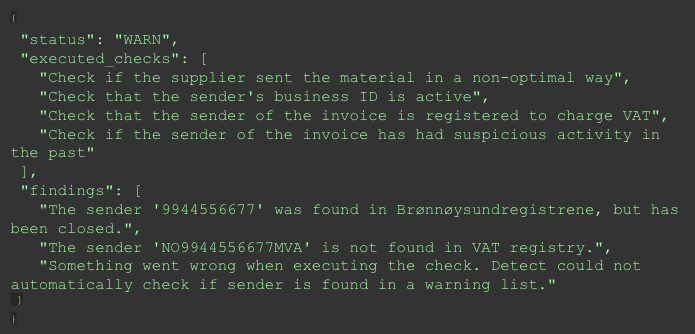

Use GET /v1/invoices/{id}/detect_results to fetch results for a specific invoice.

- The response includes results for all activated checks, only one call is needed.

- Invoices are not listed or available for download until all checks are completed.

- If a check fails to run (e.g., an external register is unavailable), it is retried.

- Maximum waiting time for invoice release is 4 hours; if a check cannot be completed within that time, it is marked as failed.

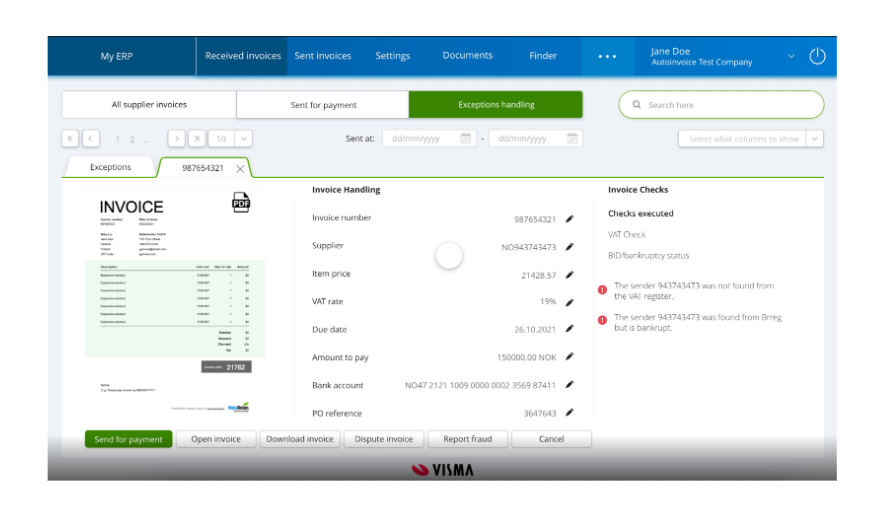

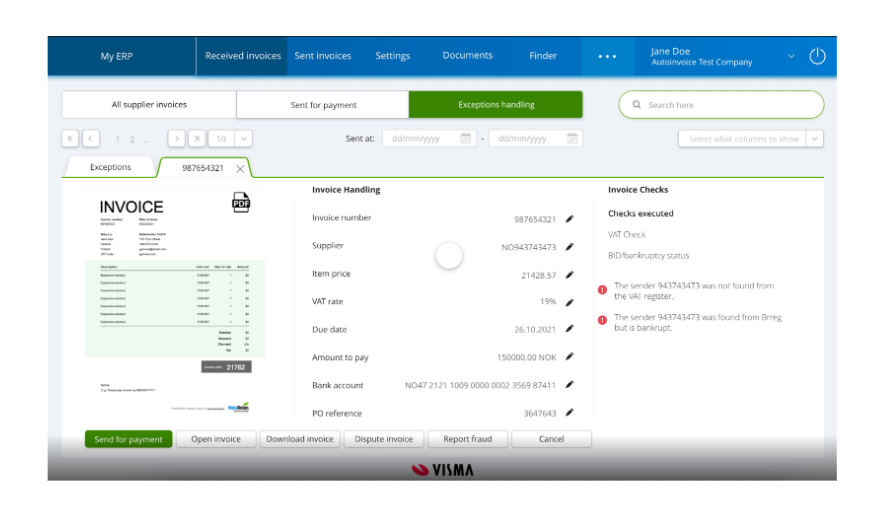

After fetching the check results, relevant notifications are shown to the user. If an issue is detected on an invoice, a notification message is displayed within the integrated system (e.g., in invoice listings, booking views, or approval screens).

All possible check results can be viewed via GET /v1/definitions/detect/checks.

Example result visualisation in user interface:

The same method used to activate checks can also be used to deactivate them:

- Call PATCH/v1/services/detect/checks to modify active checks.

- To fully close the service, deactivate all checks.

Visma does not warrant that the customers use of the check services will be uninterrupted or error-free, or that the service and/or the information obtained by the customer through the Services will meet the customers requirements. The customer acknowledges and agrees that the check services will evolve over time and that functionality may be added and removed from time to time.

The customer assumes sole responsibility for results obtained from the use of the check services and for conclusions drawn from them. Visma shall have no liability for any damage caused by errors or omissions in any information, instructions, warnings or flags provided to the customer in connection with the check services, or the customer’s actions or non-actions in response to such information.

This section provides information about the warning list check, which can be activated for a company’s incoming invoices as part of the Detect service. This guide can be shared directly with customers or used as a basis for creating user support documentation.

A warning list is a register containing alerts about suspected fraudsters and companies involved in scams or business swindles.

When an invoice is received, the sender’s company information is compared against a set of warning lists. If a match is found, a notification can be issued to the invoice receiver.

The check uses the following information from the sender:

- Company name

- Business ID

I received a notification that my invoice is from a company on a warning list. What does this mean?

Answer: The invoice sender has been identified in either a third-party register or a Visma user-generated warning list used for the warning list check.

Receiving a warning means that the company name or business ID matches information in at least one of the registers.

In the notification message, the “Source” field indicates the register where the sender was found. If the sender appears on multiple registers, all matching register names are included in the notification.

See the list of registers used and the criteria for listing companies below.

The warning list check uses a combination of well-known third-party warning lists and user-reported warnings from Visma customers.

- This set of registers is not exhaustive, and a company not appearing on a list does not guarantee the invoice or sender is legitimate.

- The information provided by the registers varies; some may include example invoices, descriptions of past fraud attempts, or other details about reported cases.

European Union Intellectual Property Office list contains warnings focused on companies doing trademark and design services scams. Usually name/logo/service appear very similar to a real organisation.

- Link to register: https://euipo.europa.eu/ohimportal/en/misleading-invoices

- Criteria for listing: Based on reported cases.

- Contact information:

- Telephone:

+34 965 139 100 - Email:

information@euipo.europa.eu

- Telephone:

- How to get unlisted:

- Contact EUIPO

Svenskhandel Varningslistan contains warnings for fraudulent invoices, companies with unscrupulous sales practices and of offers or mailings that may be perceived as misleading.

- Link to register: https://www.svenskhandel.se/sakerhetscenter/varningslistan/

- Criteria for listing: https://www.svenskhandel.se/sakerhetscenter/varningslistan/kriterier-for-publicering/

- Contact information:

- Telephone:

010-47 18 500 - Email:

info@svenskhandel.se - URL: https://www.svenskhandel.se/om-svensk-handel/kontakta-oss/

- Telephone:

- How to get unlisted:

- Contact Svenskhandel

Trygg Handel warning list contains warnings against active fraudsters and business scams/swindles.

- Link to register: https://go.trygghandel.no/warninglist

- Criteria for listing: https://go.trygghandel.no/criteria

- Contact information:

- Telephone:

+47 31 00 31 00 - Email:

support@trygghandel.no

- Telephone:

- How to get unlisted:

- Contact Trygg Handel

Visma users can report an invoice if they suspect sender to be fraudulent. Warning message states how many different invoice receivers have reported the company as suspected fraudster.

- Link to register: Register is not publicly available

- Criteria for listing: see the Visma warning list criteria below

- Contact information:

- Regular Visma support channel, or if not a Visma customer

support.maventa@visma.com

- Regular Visma support channel, or if not a Visma customer

- How to get unlisted:

- Contact Visma

It is recommended to have a routine in place for handling the situations where fraud is suspected. This includes for example confirming if the supplier has actually sent the invoice, as well as to dispute the invoice in case the basis for it is not legit. To establish your routine, check the relevant ways of operating in relation to your country and area of business.

Norway: Finanstilsynet

Finland: FIN-FSA Finanssivalvonta

Sweden: FinansInspektionen

- https://www.fi.se/

- https://www.fi.se/en/ (in English)

Denmark: Finanstilsynet

- https://www.finanstilsynet.dk/

- https://www.dfsa.dk/ (in English)

Netherlands: Autoriteit Financiële Markten

- https://www.afm.nl/nl-nl

- https://www.afm.nl/en (in English)

Norway: Brønnøysundregistrene

Finland: YTJ / PRH

Sweden: Bolagsverket

Denmark: CVR - Det Centrale Virksomhedsregister

Netherlands: KVK Chamber of Commerce

The Visma invoice sender warning list contains a user generated/crowdsourced list of companies suspected by users of the invoice service, or by a business partner of the sender, to be engaged in suspicious or fraudulent activities.

As part of the warning list check Detect uses fraud reports from customers. See more details of fraud reporting and how to integrate to it.

The companies have been listed based on one or several of the following criteria. The overall selection to enter a company to the list is done on a case by case automated and manual evaluation.

If you suspect a company is listed by mistake, please contact Visma through regular Visma support channels, or contact support.maventa@visma.com.

-

Product/service doesn’t exist

The company is selling product/service that likely doesn’t exist

-

Offers as invoices

The company sends offers and/or quotes as invoices, or that can be mistaken for being an invoice.

-

Invoices without a previous contact to customers

The company sends invoices to companies they have not previously been in contact with. The company refers to previous agreements that in reality do not exist.

-

Invoices not compliant with laws and regulations

The company is issuing invoices that are missing mandatory information or are otherwise suspected to not follow relevant laws and regulations.

-

Misleading name

The company is using a misleading name that can easily be confused with an existing, legitimate company in the same industry

-

Complaints about business activities

There have been significant amount of complaints about company’s business activities.

-

No contact information / possibility to reach the company

The company is missing any contact information or it is impossible to reach them on the contact information provided. The company documentation lacks important information such as organization number, legal entity or channel to be in contact with the company.

-

Misleading marketing/sales to customers

The company has a misleading offering or is marketing to customers in a way that is suspected to be misleading. The company does not state the total price of the product or service in the offer.

-

Company suspected of illegal business practices

The company´s business is suspected of being in violation with laws and regulations and/or are not following good business practices. The company is missing required registrations in the national company and tax registers. The company does not have a board. The company is in violation with the EU’s 5th Anti‑Money Laundering Directive or other regulations considering anti-money laundering or counter terrorist financing.

-

Known from earlier fraud attempts

The company has attempted fraud before, or is connected to companies known for fraud attempts. The company is using falsified signatures. The company is using information such as bank accounts or addresses that are previously known for suspicious/ fraud contexts. The company board members or directors are connected to other companies previously known for suspicious/ fraud contexts.

-

Known from earlier suspicious activities or connection to companies or individuals known from suspicious activities

The company has been on the media or is otherwise known for suspicious behaviour and activities. The company has connections to companies or individuals that have been on the media or are otherwise known for suspicious behaviour and activities.